If you’re selling courses on your WordPress site, it’s important to configure tax settings correctly so that your customers are charged the proper amount based on their location. Here’s how to do that:

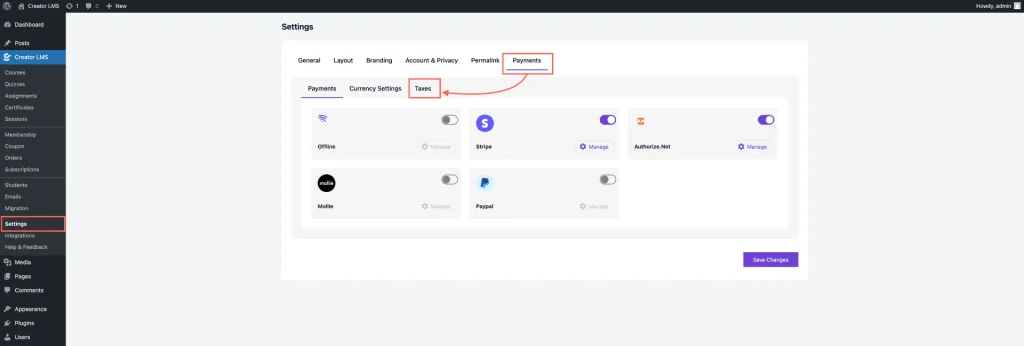

Step 1: Enable Taxes in Creator LMS

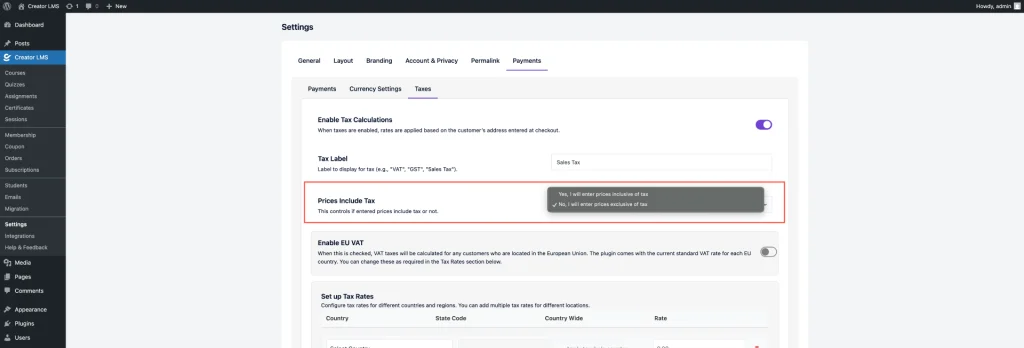

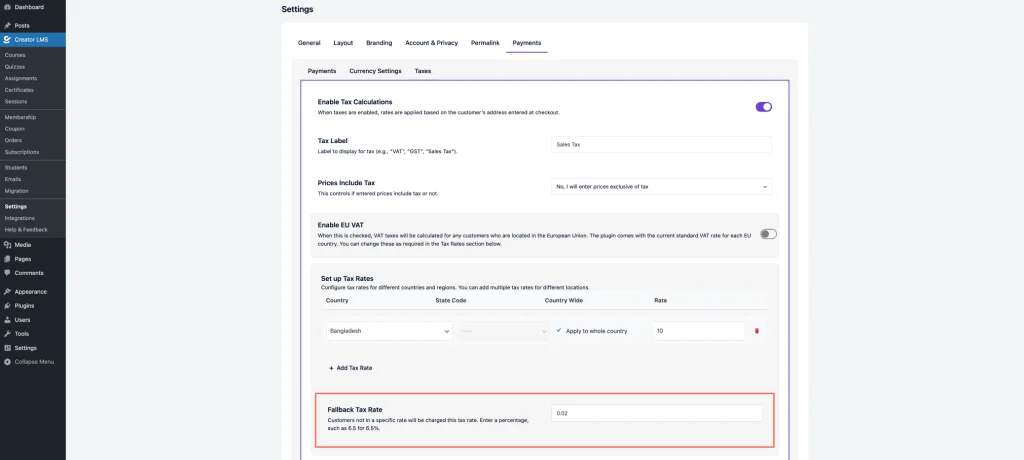

- Navigate to Creator LMS → Settings. Click on the Payments tab, and then you will find the Taxes Options

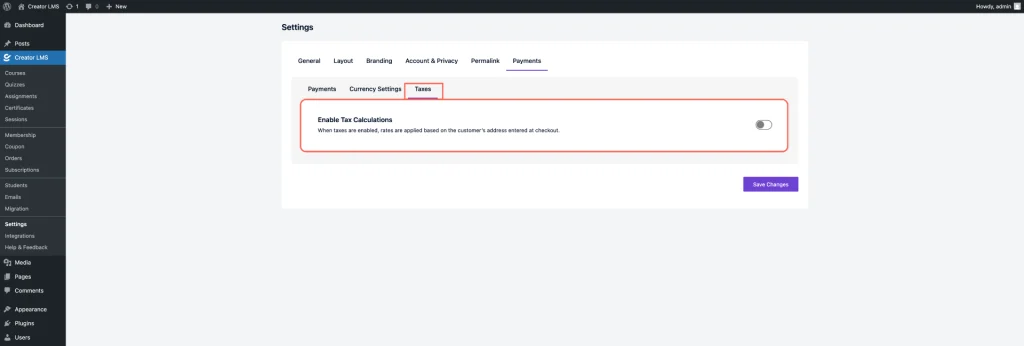

- Now, Enable the Tax Calculations.

- After turning on tax calculations, you’ll be taken to the Tax Dashboard, where you can manage all your tax-related settings.

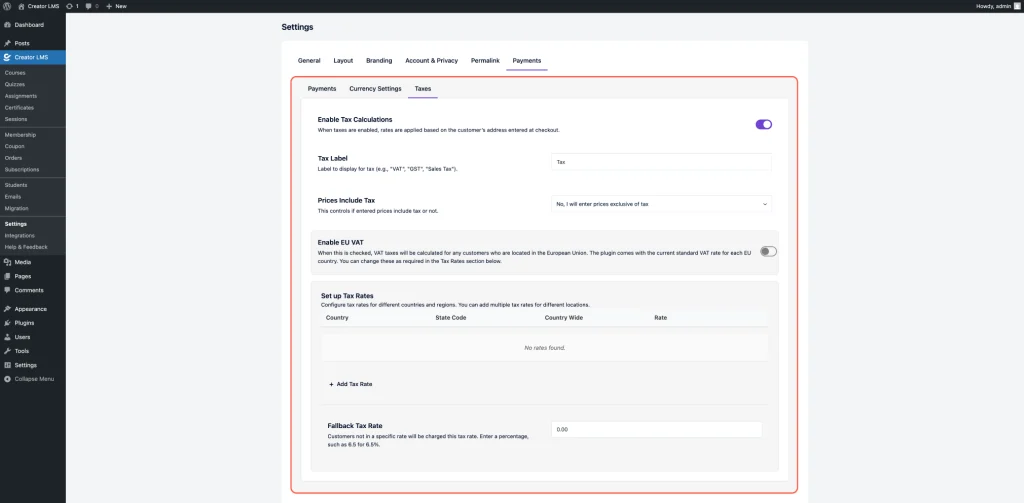

Step 2: Configure Tax Settings from the Tax Dashboard

- Enter the tax label (e.g., VAT, GST, Sales Tax) to display at checkout, then specify if prices include tax.

- Yes, prices include tax – The system will show the included tax during checkout.

- No, prices exclude tax – Tax will be added on top of the course price at checkout.

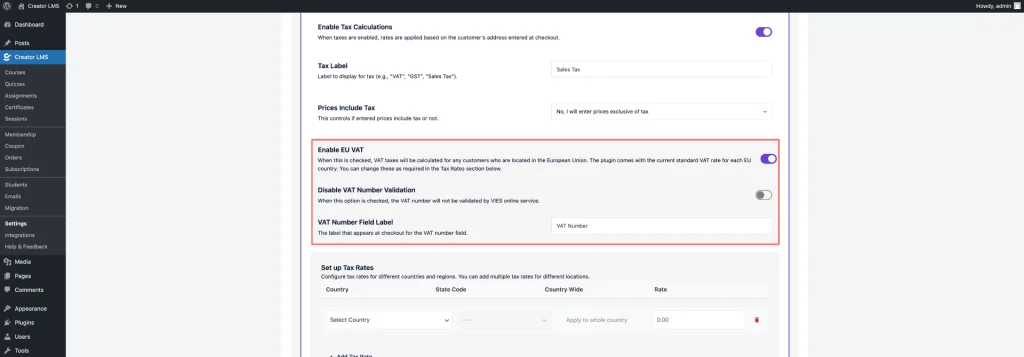

- When EU VAT is enabled, VAT will be applied to EU customers, and two options will be available:

- Disable VAT Number Validation: When this option is enabled, the system will not validate the customer’s VAT number using the VIES online service.

- VAT Number Field Label: This is the label that will be displayed for the VAT number input field on the checkout page.

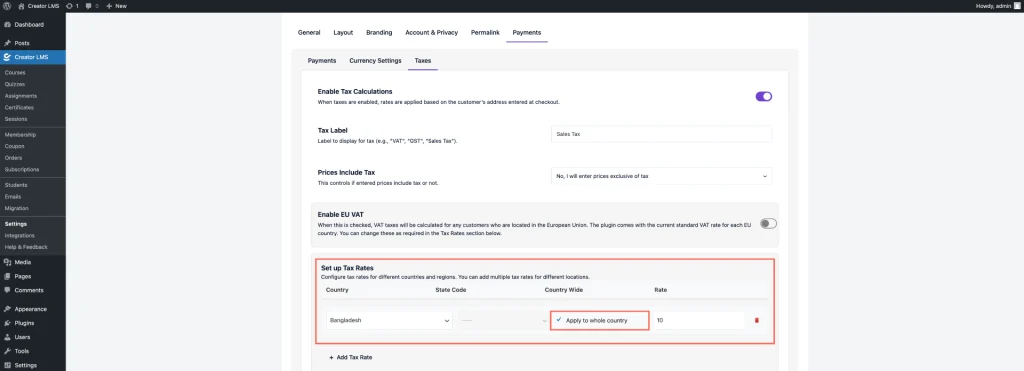

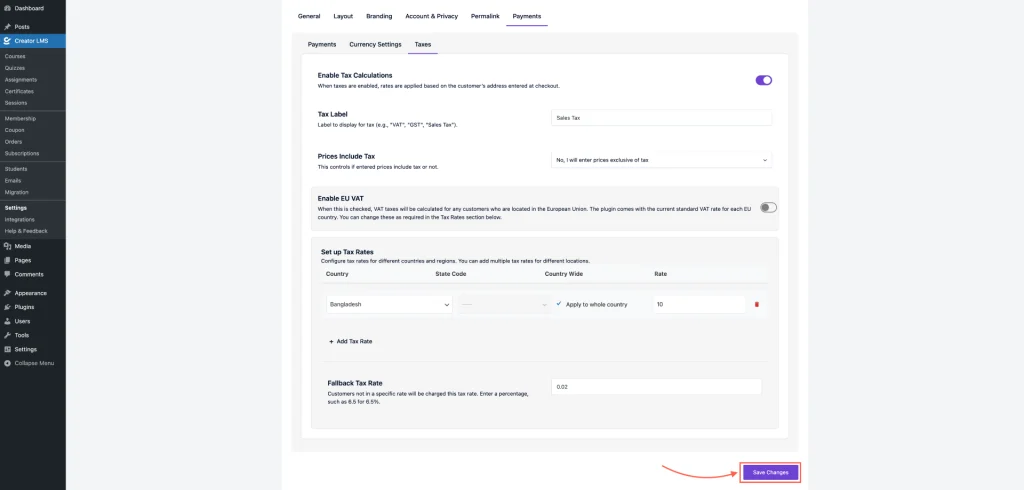

- Now, set the tax for a specific country and state. Additionally, you can set the tax for the entire country by selecting the “Apply to whole country” checkbox. Note: All tax values are not percentage-based. ⚠️

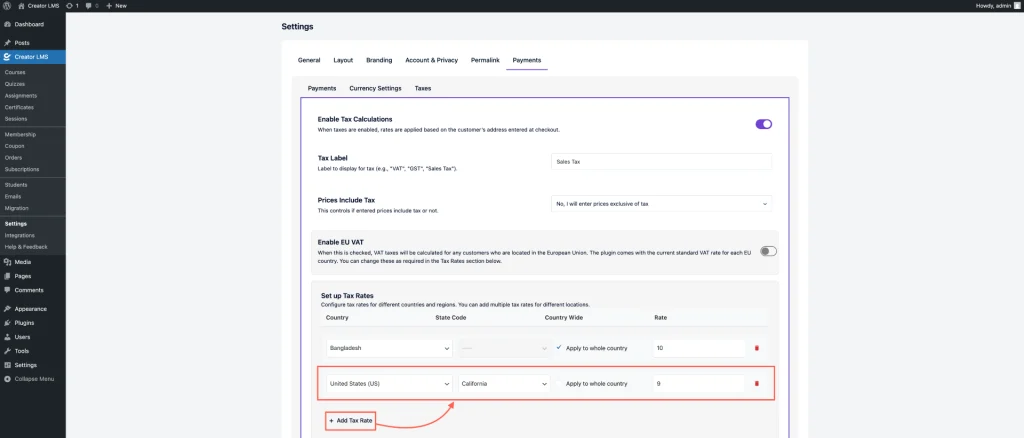

- To add a new tax rate, click on the “Add Tax Rate” button and fill in the required information. Note: All tax values are not percentage-based. ⚠️

- Finally, the Fallback Tax Rate allows you to apply a default tax rate when no specific tax rate is set for a user’s country or region.

- Once you’ve configured all your tax settings and rates, make sure to click “Save Changes” to apply your updates.

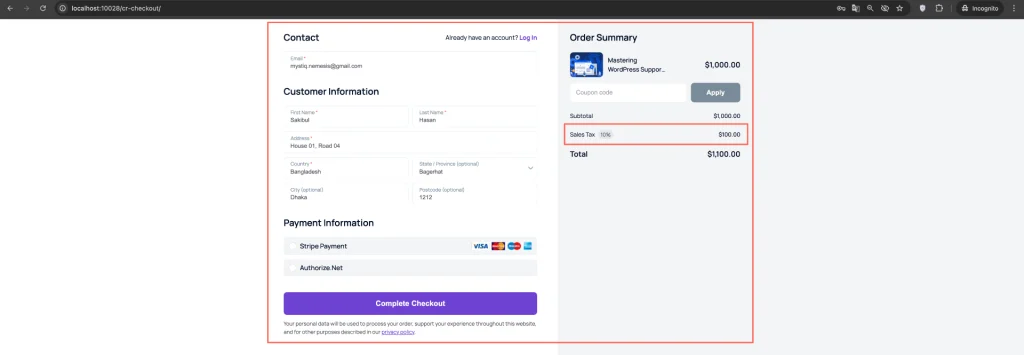

Now, when customers go to the checkout page and enter their billing details, the system will calculate the tax based on their location and display the price with the applicable tax added to the course price, ensuring they can see a clear breakdown before completing the payment.